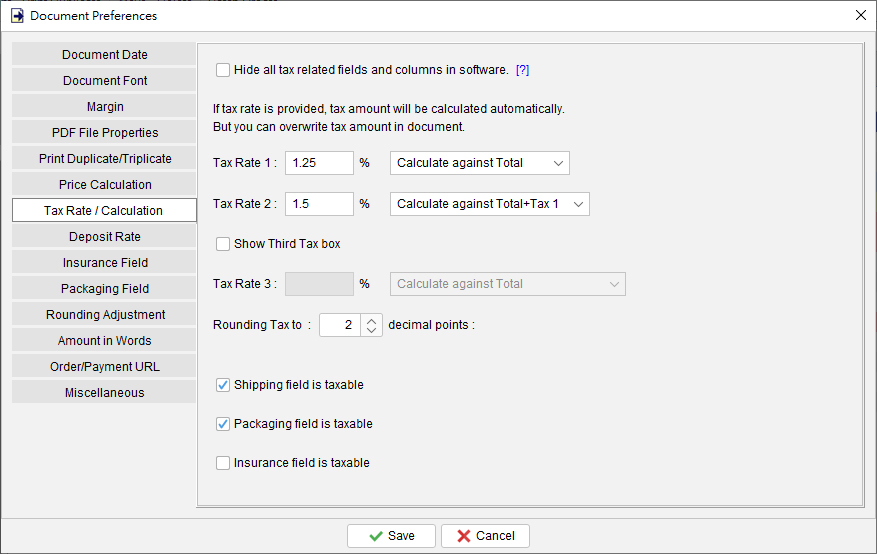

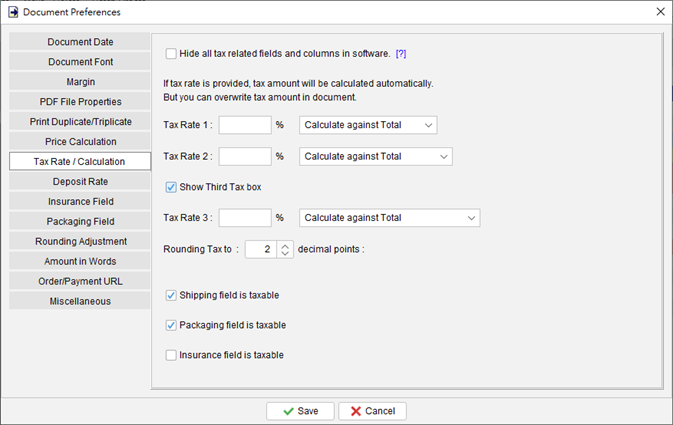

How do I set the default tax rate and deposit rate?

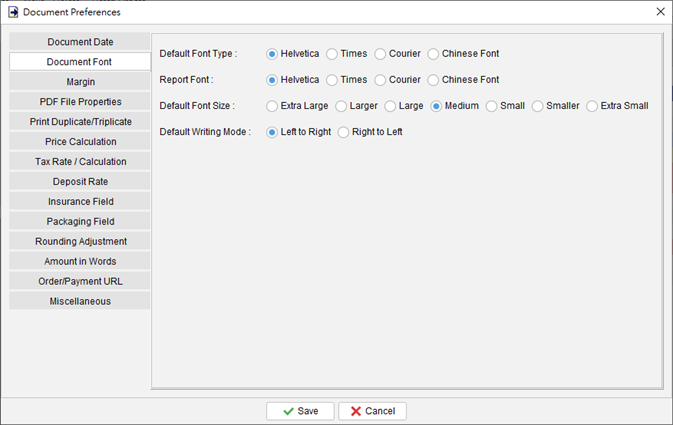

To specify the default tax rate and deposit rate in EasyBilling, follow these steps: Go to the “Customize Document” menu and select “Document Preferences”. The “Preferences” dialog box will be displayed. Within this dialog box, navigate to either the “Tax Rate/Calculation” or “Deposit” tab to access the settings for the respective rates. Set the desired … Read more